Trending...

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers - 149

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final - 103

- Pastor Saeed Abedini Releases THE TRUTH – Volume 1, A Deeply Personal Story of Faith, Struggle, and Redemption

A Delhi-NCR-based fintech Startup, BeFiSc, has launched its AI/ML-powered technology solutions for financial institutions, government agencies, and other businesses helping them to detect fraud, enrich user data, and verify information in real-time.

NOIDA, India - Michimich -- With a vision to make Digital India fraud-free, BeFiSc introduces multi-pronged fraud check solutions to mitigate risk in the onboarding journey for leading industry verticals such as Neo-Banks, Fintech, Gaming, Transportation, E-commerce, and others.

BeFiSc is founded by Shobhit Goyal, who comes with a decade-worth of experience in building and scaling digital due diligence technology.

BeFiSc's KYC solutions are designed to streamline the onboarding process, reduce the risk of fraud, and ensure compliance with global KYC standards.

More on Michimich.com

"We founded BeFiSc to advance the industry standard KYC and fraud detection tools. We wanted to go beyond mere KYC and provide actionable intelligence using robust ML models to preempt fraud. As the name suggests, we want to go beyond traditional methods of KYC and fraud detection by leveraging the latest technology" - Shobhit Goyal, BeFiSc Founder and CEO.

The startup is committed to providing an intelligent KYC process that meets the needs of the industry while also providing a friction-free user experience to their end customers. By leveraging the latest technology, BeFiSc is propelling access to technological advancement in KYC and fraud detection for everyone.

About the Solutions

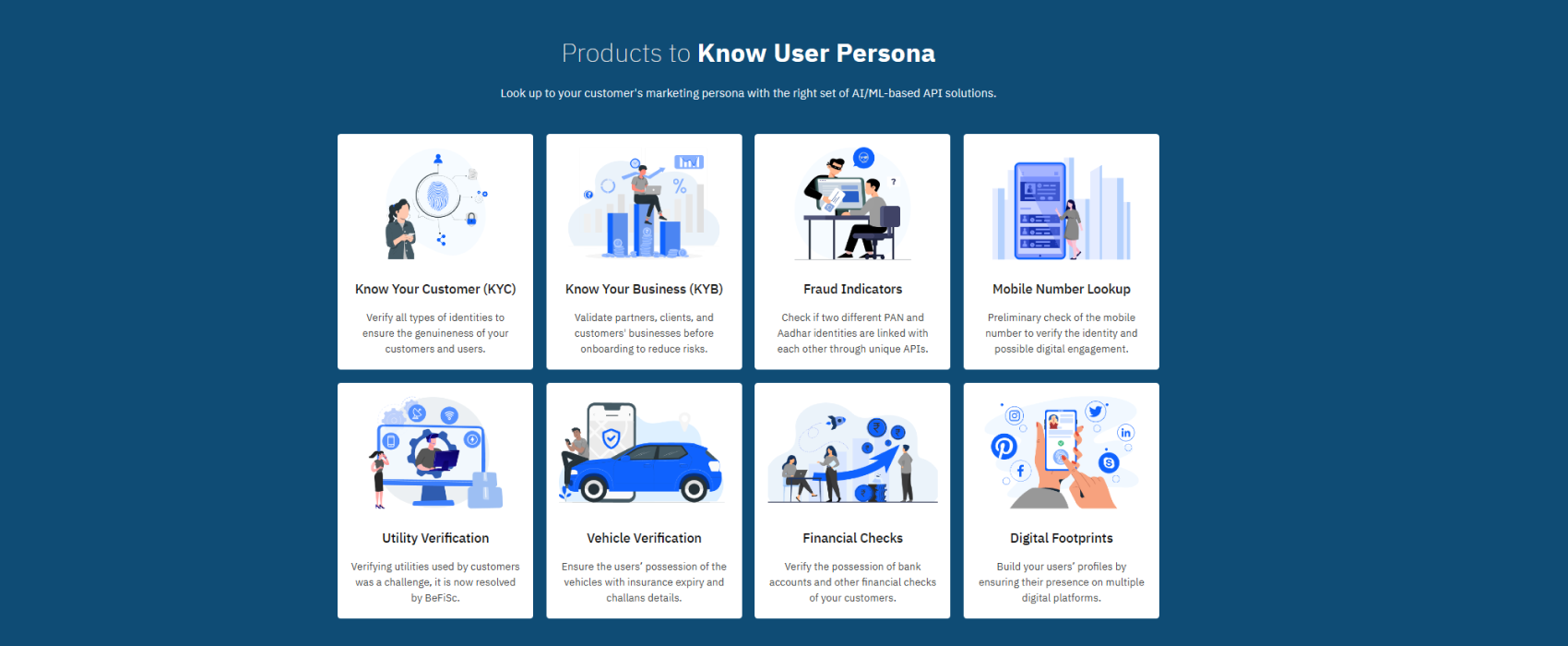

BeFiSc utilizes artificial intelligence and machine learning to provide a secure and cost-effective solution. BeFiSc caters to multiple use cases across industries, including user KYC, identity verification, financial checks, digital footprints, alternate data, fraud indicators, business verification and more.

More on Michimich.com

"We have built a one-of-a-kind solution that the market needs, but no one has worked on it until now. Our platform will evolve with more unique APIs, revolutionizing digital identity, risk signals, and proactive fraud detection to understand user personas better," added Mr. Goyal.

About BeFiSc:

Beyond Financial Score (BeFiSc), a fintech startup founded in 2023, is a trusted and reliable platform for KYC, fraud, and risk management. Combining data, technology, machine learning, and artificial intelligence, BeFiSc provides accurate user verification and data enrichment tools, delivering real-time results.

Visit https://www.befisc.com/ for more information.

BeFiSc is founded by Shobhit Goyal, who comes with a decade-worth of experience in building and scaling digital due diligence technology.

BeFiSc's KYC solutions are designed to streamline the onboarding process, reduce the risk of fraud, and ensure compliance with global KYC standards.

More on Michimich.com

- Midwest Enviro Solutions Urges Homeowners & Businesses to Recognize Symptoms of Poor Indoor Air Qua

- $317M Revenue and a Clear Path to $1B: $IQST is Positioned for a Major Profitability Inflection

- Michigan Computer Supplies Shares Simple Maintenance Tips to Extend Office Printer Life & Reduce Em

- ASI Hosts 2026 Executive Business Summit for Global Partner Community

- Pastor Saeed Abedini Releases THE TRUTH – Volume 1, A Deeply Personal Story of Faith, Struggle, and Redemption

"We founded BeFiSc to advance the industry standard KYC and fraud detection tools. We wanted to go beyond mere KYC and provide actionable intelligence using robust ML models to preempt fraud. As the name suggests, we want to go beyond traditional methods of KYC and fraud detection by leveraging the latest technology" - Shobhit Goyal, BeFiSc Founder and CEO.

The startup is committed to providing an intelligent KYC process that meets the needs of the industry while also providing a friction-free user experience to their end customers. By leveraging the latest technology, BeFiSc is propelling access to technological advancement in KYC and fraud detection for everyone.

About the Solutions

BeFiSc utilizes artificial intelligence and machine learning to provide a secure and cost-effective solution. BeFiSc caters to multiple use cases across industries, including user KYC, identity verification, financial checks, digital footprints, alternate data, fraud indicators, business verification and more.

More on Michimich.com

- New Book Warring From the Standpoint of the Throne Room Calls Believers to Pray From Victory

- Scotch Whisky Market Dislocation Creates Compelling Entry Opportunity for Long-Term Investors

- Peccioli Becomes New Orleans: In July 2026, the magic of jazz comes to Tuscany

- Michigan Debt Collection Agency Helps Businesses Create Airtight Credit Policies

- Michigan Collection Services Firm Describes Different Types of Defendants

"We have built a one-of-a-kind solution that the market needs, but no one has worked on it until now. Our platform will evolve with more unique APIs, revolutionizing digital identity, risk signals, and proactive fraud detection to understand user personas better," added Mr. Goyal.

About BeFiSc:

Beyond Financial Score (BeFiSc), a fintech startup founded in 2023, is a trusted and reliable platform for KYC, fraud, and risk management. Combining data, technology, machine learning, and artificial intelligence, BeFiSc provides accurate user verification and data enrichment tools, delivering real-time results.

Visit https://www.befisc.com/ for more information.

Source: BeFiSc

0 Comments

Latest on Michimich.com

- NRx Pharmaceuticals Launches Breakthrough One-Day Treatment Clinic in Florida as FDA Pathway and Clinical Data Strengthen Growth Outlook; $NRXP

- Revenue Optics Launches Talent Infrastructure Platform for SaaS Revenue Hiring and Appoints Sabz Kaur to Lead Growth

- Building a Multi-Domain Autonomous Systems Platform at the Intersection of AI, Defense and Infrastructure: VisionWave Holdings (N A S D A Q: VWAV)

- Bent Danholm Named "Top Luxury Real Estate Leader" in Modern Luxury Miami

- Author Ken Mora to Celebrate New Caravaggio Book Debut with Special Event at Palazzo Venezia Naples

- Matthew Sisneros Releases Raw and Unfiltered Memoir: The Devil Lost Another One — A Powerful Story of Crime, Consequence, and Redemption

- From Life to Light: Jess L. Martinez Shares a Soulful Poetry Collection That Explores What It Means to Be Human

- Lawsuit Filed Against Boeing Over Defective Seat Switch on Boeing 787

- Quadcode Acquires Significant Stake in Game 7, LLC - The Parent Company for FPFX Tech and PropAccount.com

- LoanCraft Named Fannie Mae Technology Service Provider for Income Calculator

- Danholm Collection Announces Sale of 16689 Broadwater Ave in Winter Garden, Highlighting Strong Performance in Twinwaters Community

- Raven Carbide Dies Shares Best Practices for Maintaining and Extending Carbide Die Life

- The Truth About Dealer vs. Independent European Repair: More Options for Ann Arbor Drivers Than Ever

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Bonavita Luxury & Portable Lavatories Announces Rebrand to Bonavita Site Solutions

- Raleigh Emerges as a Key Player in Sustainable Fashion Innovation for 2026

- New Online Tool Helps Parents Determine If Their Children Are Overscheduled

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final