Trending...

- Lick Personal Oils Introduces the Ultimate Valentine's Day Gift Collection for Romantic, Thoughtful Gifting - 151

- Walmart $WMT and COSTCO.COM $COST Distribution as SonicShieldX™ Platform Sets the Stage for Accelerated Growth in 2026: AXIL Brands (N Y S E: AXIL) - 130

- IQSTEL Enters 2026 from a Position of Strength Following Transformational Year Marked by N A S D A Q Uplisting, Record Revenue and First-Ever - 110

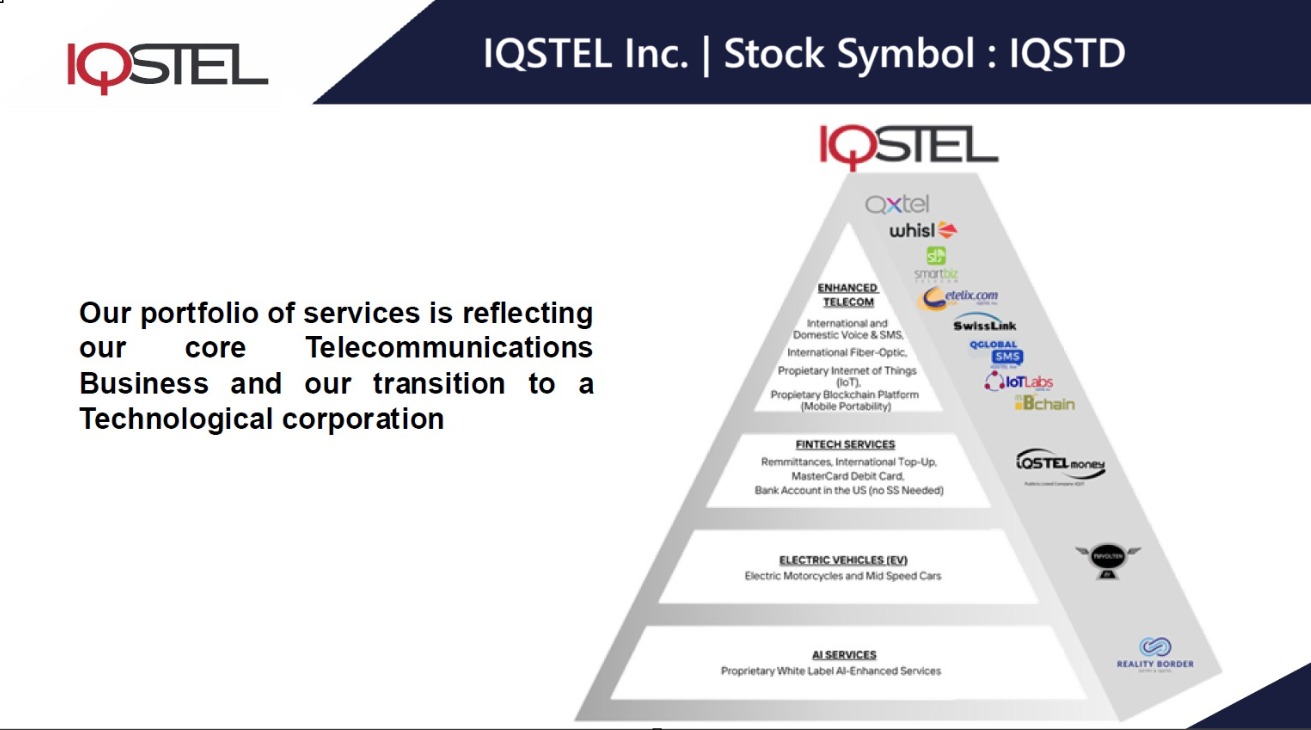

IQSTEL, Inc. (Stock Symbol: IQSTD) On Track Towards $1 Billion in Revenue by 2027.

CORAL GABLES, Fla. - Michimich -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

$340 Million Revenue Forecast for 2025.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

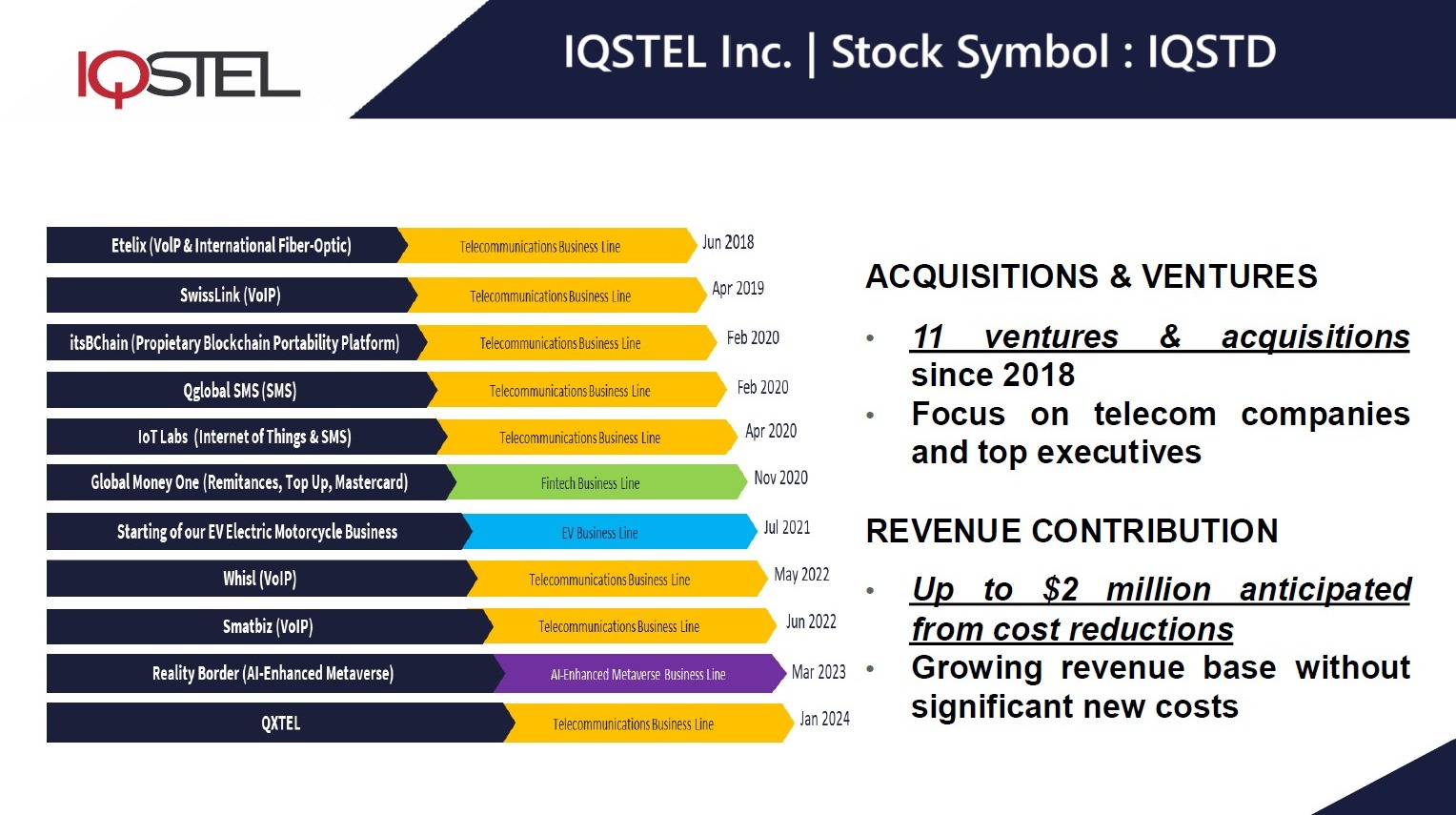

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Preliminary Q1 2025 Delivering Net Revenue of $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Strategic Decision to Uplist to NASDAQ for Multiple Corporate Advantages Utilizing Reverse Stock Split to Meet Minimum Listing Requirements.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

IQSTD Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQSTD) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQSTD offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQSTD delivers high-value, high-margin services to its extensive global customer base. IQSTD projects $340 million in revenue for FY-2025, building on its strong business platform.

IQSTD has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQSTD is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Strong Preliminary Q1 2025 Results: Revenue Growth, Margin Expansion and Strategic Progress Toward NASDAQ Uplisting

On May 6th IQSTD announced its preliminary first quarter 2025 financial results, delivering strong double-digit growth in revenue and a 40% increase in gross profit, reflecting continued improvements toward achieving profitability. These results reinforce the company's commitment to long-term value creation through strategic initiatives, including its planned NASDAQ uplisting and acquisition-driven growth strategy.

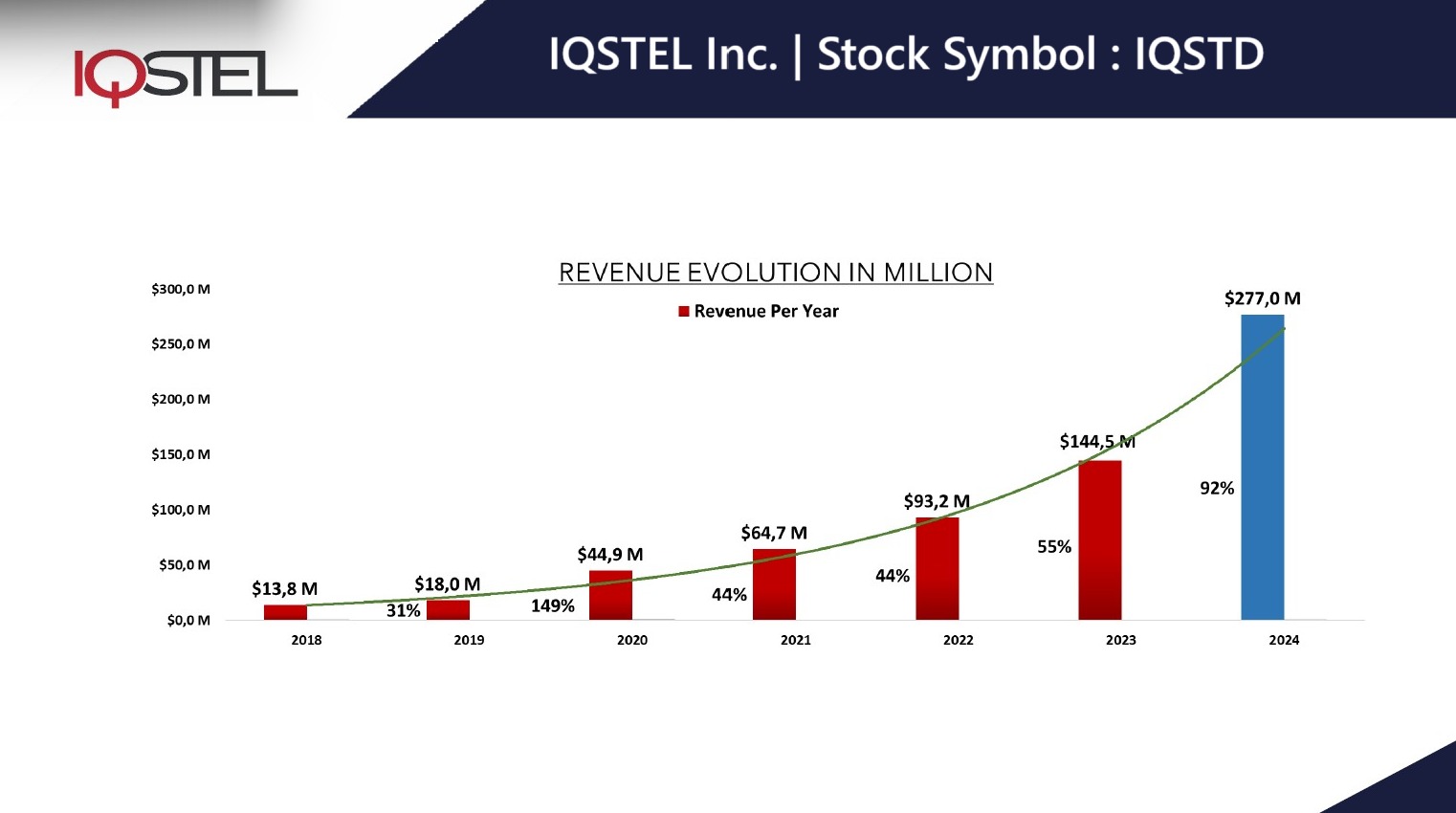

More on Michimich.com

IQSTD has a successful track record of improving year over year across key operational financial metrics—including revenue, gross profit, EBITDA, assets, among others—while growing at a gigantic pace of 96% year-over-year. This performance demonstrates consistent execution and the scalability of its business model.

Preliminary Q1 2025 Financial Highlights

Net Revenue: $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Gross Profit: $1.93 million, a 40% increase from $1.38 million in Q1 2024.

Gross Margin: Improved to 3.36%, a 25% increase from 2.68% in Q1 2024.

Adjusted EBITDA (Telecom Division): $593,604.

Q4 2024 Revenue Reference: $98.8 million, highlighting the company's strong momentum heading into 2025. Historically, IQSTEL's second-half performance has significantly outpaced the first half, reinforcing confidence in continued growth.

The IQSTD business platform is the result of years of sustained effort, technological development, and commercial trust-building. Establishing this platform required securing interconnection agreements with the largest telecommunications networks worldwide—a process that is highly complex, resource-intensive, and not easily replicated.

IQSTD has successfully built a global network of trusted customers and vendors, exchanging hundreds of millions of dollars annually. This level of commercial reliability and mutual trust has created a resilient and strategically valuable operating ecosystem.

IQSTD has built a stable and scalable business model. With the platform firmly in place, IQSTD is now leveraging it to offer high-tech, high-margin products—including AI-powered tools, fintech services, and cybersecurity solutions—through its existing global customer base.

Strategic Decision to Uplist to NASDAQ Utilizing Reverse Stock Split to Meet Minimum Listing Requirements

On May 2nd IQSTD announced the strategic decision to uplist to the NASDAQ stock exchange. As part of this process, IQSTD has executed a reverse stock split at a ratio of 80:1 to meet the minimum share price required for listing. With $283 million in revenue reported for 2024 and a 96% year-over-year growth rate, IQSTD is poised to enter a new phase of growth and recognition on a national exchange.

More on Michimich.com

As a result of the reverse split, there will be approximately 2,633,878 shares of common stock outstanding. Upon the effectiveness of the reverse split, there will also be a proportional decrease of the Company's authorized shares of common stock at the same ratio of 1-for-80, resulting in approximately 3,750,000 authorized shares of common stock following the action.

IQSTD is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with its long-term vision of building a profitable $1 billion revenue company.

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

IQSTD plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQSTD broader efforts to enhance shareholder participation and liquidity.

For more information on $IQSTD visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQSTD)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

$340 Million Revenue Forecast for 2025.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Preliminary Q1 2025 Delivering Net Revenue of $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Strategic Decision to Uplist to NASDAQ for Multiple Corporate Advantages Utilizing Reverse Stock Split to Meet Minimum Listing Requirements.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

IQSTD Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQSTD) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQSTD offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQSTD delivers high-value, high-margin services to its extensive global customer base. IQSTD projects $340 million in revenue for FY-2025, building on its strong business platform.

IQSTD has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQSTD is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Strong Preliminary Q1 2025 Results: Revenue Growth, Margin Expansion and Strategic Progress Toward NASDAQ Uplisting

On May 6th IQSTD announced its preliminary first quarter 2025 financial results, delivering strong double-digit growth in revenue and a 40% increase in gross profit, reflecting continued improvements toward achieving profitability. These results reinforce the company's commitment to long-term value creation through strategic initiatives, including its planned NASDAQ uplisting and acquisition-driven growth strategy.

More on Michimich.com

- Reditus Group Introduces A New Empirical Model for Early-Stage B2B Growth

- CCHR: Harvard Review Exposes Institutional Corruption in Global Mental Health

- Goatimus Launches Dynamic Context: AI Prompt Engineering Gets Smarter

- Global License Exclusive Secured for Emesyl OTC Nausea Relief, Expanding Multi-Product Growth Strategy for Caring Brands, Inc. (N A S D A Q: CABR)

- RNHA Affirms Support for President Trump as Nation Marks Historic Victory for Freedom

IQSTD has a successful track record of improving year over year across key operational financial metrics—including revenue, gross profit, EBITDA, assets, among others—while growing at a gigantic pace of 96% year-over-year. This performance demonstrates consistent execution and the scalability of its business model.

Preliminary Q1 2025 Financial Highlights

Net Revenue: $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Gross Profit: $1.93 million, a 40% increase from $1.38 million in Q1 2024.

Gross Margin: Improved to 3.36%, a 25% increase from 2.68% in Q1 2024.

Adjusted EBITDA (Telecom Division): $593,604.

Q4 2024 Revenue Reference: $98.8 million, highlighting the company's strong momentum heading into 2025. Historically, IQSTEL's second-half performance has significantly outpaced the first half, reinforcing confidence in continued growth.

The IQSTD business platform is the result of years of sustained effort, technological development, and commercial trust-building. Establishing this platform required securing interconnection agreements with the largest telecommunications networks worldwide—a process that is highly complex, resource-intensive, and not easily replicated.

IQSTD has successfully built a global network of trusted customers and vendors, exchanging hundreds of millions of dollars annually. This level of commercial reliability and mutual trust has created a resilient and strategically valuable operating ecosystem.

IQSTD has built a stable and scalable business model. With the platform firmly in place, IQSTD is now leveraging it to offer high-tech, high-margin products—including AI-powered tools, fintech services, and cybersecurity solutions—through its existing global customer base.

Strategic Decision to Uplist to NASDAQ Utilizing Reverse Stock Split to Meet Minimum Listing Requirements

On May 2nd IQSTD announced the strategic decision to uplist to the NASDAQ stock exchange. As part of this process, IQSTD has executed a reverse stock split at a ratio of 80:1 to meet the minimum share price required for listing. With $283 million in revenue reported for 2024 and a 96% year-over-year growth rate, IQSTD is poised to enter a new phase of growth and recognition on a national exchange.

More on Michimich.com

- American Laser Study Club Announces 2026 Kumar Patel Prize in Laser Surgery Recipients: Ann Bynum, DDS, and Boaz Man, DVM

- Lineus Medical Completes UK Registration for SafeBreak® Vascular

- Canyons & Chefs Announces Revamped Homepage

- $140 to $145 Million in 2026 Projected and Profiled in New BD Deep Research Report on its Position in $57 Billion US Marine Industry; N Y S E: OTH

As a result of the reverse split, there will be approximately 2,633,878 shares of common stock outstanding. Upon the effectiveness of the reverse split, there will also be a proportional decrease of the Company's authorized shares of common stock at the same ratio of 1-for-80, resulting in approximately 3,750,000 authorized shares of common stock following the action.

IQSTD is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with its long-term vision of building a profitable $1 billion revenue company.

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

IQSTD plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQSTD broader efforts to enhance shareholder participation and liquidity.

For more information on $IQSTD visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQSTD)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on Michimich.com

- The New Monaco of the South (of Italy)

- Churchill Systems Inc. Enhances Flagship Forecaster to Target Retail's Promotion Blindspot

- Lick Personal Oils Introduces the Ultimate Valentine's Day Gift Collection for Romantic, Thoughtful Gifting

- Everyday Ascend Announces New Home Base as Brand Reaches Major Growth Milestone

- Lacy Hendricks Earns Prestigious MPM® Designation from NARPM®

- Walmart $WMT and COSTCO.COM $COST Distribution as SonicShieldX™ Platform Sets the Stage for Accelerated Growth in 2026: AXIL Brands (N Y S E: AXIL)

- AI-Driven Drug Development with Publication of New Bioinformatics Whitepaper for BullFrog AI: $BFRG Strengthens Its Position in AI Drug Development

- IQSTEL Enters 2026 from a Position of Strength Following Transformational Year Marked by N A S D A Q Uplisting, Record Revenue and First-Ever

- Patient Prevents Back and Disc Surgery At Macomb Township Chiropractic

- Macomb Township Chiropractic Helps Patient With TMJ Jaw Pain

- Are You Hiring The Right Heater Repair Company in Philly?

- Appliance EMT Expands Professional Appliance Repair Services to Hartford, Connecticut

- Java Holdings LLC Acquires +Peptide, Expanding Portfolio Across Coffee, Science, and Functional Nutrition

- OneSolution® Expands to Orlando with New Altamonte Springs Implant Center

- PSED Law Announces Merger With Suzanne R. Fanning, PLLC, Expanding Its Estate Planning Practice

- Indian Peaks Veterinary Hospital Launches Updated Dental Services Page for Boulder Pet Owners

- Dugan Air Donates $10,000 to Indian Creek Schools

- Robert DeMaio, Phinge Founder & CEO, Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

- 2025: A Turning Point for Human Rights. CCHR Demands End to Coercive Psychiatry

- The 22% Tax Reality: Finland's New Gambling Law Creates a "Fiscal Trap" for Grey Market Casino Players