Trending...

- "Micro-Studio": Why San Diegans are Swapping Crowded Gyms for Private, One-on-One Training at Sweat Society - 178

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026 - 130

- Nextvisit Co-Founder Ryan Yannelli Identifies Six Critical Factors for Behavioral Health Providers Evaluating AI Scribes in 2026

Enabling Startup and Corporate, to Build, Fund and Launch Disruption with Impact.

NEW YORK - Michimich -- The OnDemand Venture Capital ™

OneTraction, a Stanford Research Park based Incubator and Startup Tech Labs, unveiled the launch of On-Demand Venture Capital ™, which aim to disrupt both VC funds and startup funding, go to market and exit. The compelling key differentiators are:

Venture Capital Fund: Lead with the Fortune 500 Companies investments capability of $200 Billions.

• Fund will support startups that help reach one goal (Improve One Billion Human Life). • Fund does not earn management fees and project to outperform the top 5% VC Funds. • Fund focus on supplementing corporate initiatives to help alleviate industry challenges • Fund comes entirely from Global Fortune 500 Companies and tech industry leaders

Startup Funding: Lead and follow up at each startup cycle (Product, Revenues and Exits).

Funding are available for Global Startups across stages from Post-Accelerator Seed to Unicorn

Funding are milestone based not round "On-Demand", to sustain customers revenue generation

Funding of emerging tech (Software/Hardware) across industry with positive impact to end users

Startup Go-to-Market (GTM): Instant Access to Billions Global Customer through Fortune 500 Partners.

Vetted Disruptive Global Startup with $1 million USD or more ARR (Annual Recurring Revenue).

Real-time access to one million Global Startup, all Fortune 500 companies and 1000's mentors.

Position Startup to close $1m+ USD order from first corporate customer or partner within 90 days.

Enables Unicorn Startups to scale at the industry level (Multi-Corporate Channels) or exit faster.

On-Demand Innovation ™: Tech Labs Incubator for expert founders from universities and Fortune 500.

Innovation as a Service for domain expert founders (PhD, MD, JD) with disruptive innovation.

More on Michimich.com

Access to 50,000 Designers and Engineers through Fortune 500 Global Partners Ecosystem.

Fortune 500 and Top Universities IP's, with Milestone Funding and no upfront cost or equity.

Case Studies: Given the sheer size of OneTraction ecosystem, which is over 150,000 Corporate Leaders, Accredited Investors, and over one million funneled global startups from past batch and peers network, along its focus on making the startup cycle more efficient and beneficial to all stakeholders, the following are the most recent metrics of their global ecosystem:

Projection: OneTraction is currently raising a global innovation fund of $1 Billion USD, which comes exclusively from their one Fortune 500 customers and expected to close this year (50+ already signed up and ready to invest directly while fund close), along a launch of IaaS (Innovation as a service) Tech Labs at top Universities (Stanford, UC, Harvard, MIT and Columbia), scale their LaunchPad to reach a real time transactional capability that capture the full cycle automation of startup execution. And lastly run Exclusive Annual and Regional GTM events where 500 Corporate meet 500 startups who meet 500 investors at Top Universities, Fortune 500 venues and Cruise liners (already executed 100+ events).

About: OneTraction early founding team and investors, are serial entrepreneurs with multi-exits and comes from broad background, including Y Combinator, Sequoia, Google, Amazon, Stanford GSB, Harvard HBS, MIT PhD's and Fortune 500 Executives Board Members. Since its inception OneTraction gradually executed against its vision by helping startup reach the OneTraction as a multi-million dollars revenues deal from a single corporate client, their historical milestones are:

More on Michimich.com

Join our global Founders, Investors and Corporate leaders and members only events here:

www.onetraction.vc / LaunchPad or explore detailed profiles of promising startups from across the globe, stages and industries here: https://launchpad.technology

Figure 1: 2020 Emerging Venture Capital Models Benchmark, visualize the Venture Capital Industry performance against On-Demand Venture Capital Model and its Impact on Startup (Faster Access to Funding), Investors (Lower cost and risks with higher return) and corporate (large global startups pool access with faster go to market and lower acquisition cost).

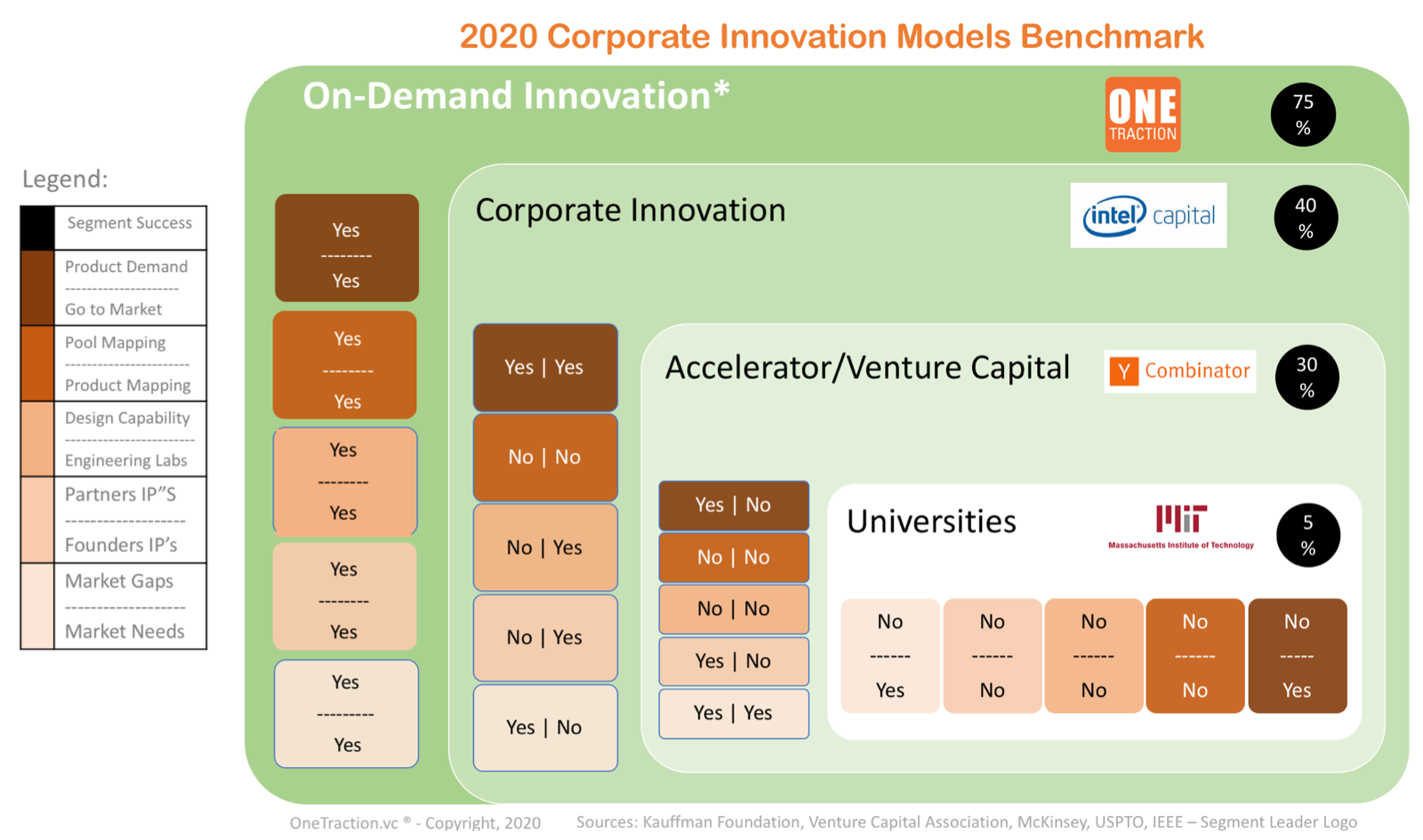

Figure 2: 2020 Corporate Innovation Models Benchmark, visualize the Industry performance against On-Demand Innovation Model and its Impact on Innovation Commercialization (Root Cause and Capability Gaps that contribute to new product commercialization failures).

Disclaimer: ecosystem include own and peer network accounts, portfolio include startup with equity interest, investments, revenues and exit deals are not publicly announced and remain undisclosed unless stated otherwise by respective startup and corporate customers. Portfolio data posted on third party aggregators including CrunchBase and Pitchbook is inaccurate and not factual. Services requiring broker dealer and other investments licensing are handled by external partners who meet and exceed all regulatory requirement. Third party logo listed above, are for demonstration purpose to showcase example of industry peers, for the sole intention to help reader understand the complex visual graph, and not intended to portray or compare any organization in any shape or form. Logo are licensed under the GFDL.

OneTraction, a Stanford Research Park based Incubator and Startup Tech Labs, unveiled the launch of On-Demand Venture Capital ™, which aim to disrupt both VC funds and startup funding, go to market and exit. The compelling key differentiators are:

Venture Capital Fund: Lead with the Fortune 500 Companies investments capability of $200 Billions.

• Fund will support startups that help reach one goal (Improve One Billion Human Life). • Fund does not earn management fees and project to outperform the top 5% VC Funds. • Fund focus on supplementing corporate initiatives to help alleviate industry challenges • Fund comes entirely from Global Fortune 500 Companies and tech industry leaders

Startup Funding: Lead and follow up at each startup cycle (Product, Revenues and Exits).

Funding are available for Global Startups across stages from Post-Accelerator Seed to Unicorn

Funding are milestone based not round "On-Demand", to sustain customers revenue generation

Funding of emerging tech (Software/Hardware) across industry with positive impact to end users

Startup Go-to-Market (GTM): Instant Access to Billions Global Customer through Fortune 500 Partners.

Vetted Disruptive Global Startup with $1 million USD or more ARR (Annual Recurring Revenue).

Real-time access to one million Global Startup, all Fortune 500 companies and 1000's mentors.

Position Startup to close $1m+ USD order from first corporate customer or partner within 90 days.

Enables Unicorn Startups to scale at the industry level (Multi-Corporate Channels) or exit faster.

On-Demand Innovation ™: Tech Labs Incubator for expert founders from universities and Fortune 500.

Innovation as a Service for domain expert founders (PhD, MD, JD) with disruptive innovation.

More on Michimich.com

- Guests Can Save 25 Percent Off Last Minute Bookings at KeysCaribbean's Village at Hawks Cay Villas

- Trump's Executive Order Rescheduling Cannabis: Accelerating M&A in a Multibillion-Dollar Industry

- Genuine Hospitality, LLC Selected to Operate Hilton Garden Inn Birmingham SE / Liberty Park

- Tickeron Debuts AI Agents with Corridor Exits for GS, NVDA, GOOG, JPM, Achieving Up to +31% Returns

- Documentary "Prescription for Violence: Psychiatry's Deadly Side Effects" Premieres, Exposes Link Between Psychiatric Drugs and Acts of Mass Violence

Access to 50,000 Designers and Engineers through Fortune 500 Global Partners Ecosystem.

Fortune 500 and Top Universities IP's, with Milestone Funding and no upfront cost or equity.

Case Studies: Given the sheer size of OneTraction ecosystem, which is over 150,000 Corporate Leaders, Accredited Investors, and over one million funneled global startups from past batch and peers network, along its focus on making the startup cycle more efficient and beneficial to all stakeholders, the following are the most recent metrics of their global ecosystem:

- Ecosystem: (160k) 50,000 Fortune 500 Customers / Investors, 10,000 Startups, 100,000 users.

- Startups Funding: ($5 Billions USD) Direct (Non-Fund) and External (Non-Fund and Funds).

- Global Fortune 500 Companies: (500) Early Adopters Members, Customers and Partners.

- Portfolio and ecosystem Startups: $200 million USD revenues and 300 million B2B/B2C users

- Exits: high rate of startup exits with Google, Apple and several IPO's through NASDAQ.

Projection: OneTraction is currently raising a global innovation fund of $1 Billion USD, which comes exclusively from their one Fortune 500 customers and expected to close this year (50+ already signed up and ready to invest directly while fund close), along a launch of IaaS (Innovation as a service) Tech Labs at top Universities (Stanford, UC, Harvard, MIT and Columbia), scale their LaunchPad to reach a real time transactional capability that capture the full cycle automation of startup execution. And lastly run Exclusive Annual and Regional GTM events where 500 Corporate meet 500 startups who meet 500 investors at Top Universities, Fortune 500 venues and Cruise liners (already executed 100+ events).

About: OneTraction early founding team and investors, are serial entrepreneurs with multi-exits and comes from broad background, including Y Combinator, Sequoia, Google, Amazon, Stanford GSB, Harvard HBS, MIT PhD's and Fortune 500 Executives Board Members. Since its inception OneTraction gradually executed against its vision by helping startup reach the OneTraction as a multi-million dollars revenues deal from a single corporate client, their historical milestones are:

More on Michimich.com

- Price Improvement on Luxurious Lāna'i Townhome with Stunning Ocean Views

- Nextvisit Co-Founder Ryan Yannelli Identifies Six Critical Factors for Behavioral Health Providers Evaluating AI Scribes in 2026

- CredHub and Real Property Management Join Forces to Empower Franchise Owners with Rental Payment Credit Reporting Solutions

- Leimert Park Announces Weeklong Kwanzaa Festival & Kwanzaa Parade Celebrating Black History, Culture, and Community

- Renowned Alternative Medicine Specialist Dr. Sebi and His African Bio Mineral Balance Therapy Are the Focus of New Book

- 24/7 Accelerator (Work, Live, Pitch) model with 200+ startups, launched from Atherton mansion

- Global Virtual Accelerator Program run by A team from Silicon Valley, enrolling 1000's startups

- Global Tech Labs, run by MIT, Google and Mckinsey A team with 1000's global developments

- On-Demand Innovation Program funded by On-Demand Venture Capital from Fortune 500 Funds

Join our global Founders, Investors and Corporate leaders and members only events here:

www.onetraction.vc / LaunchPad or explore detailed profiles of promising startups from across the globe, stages and industries here: https://launchpad.technology

Figure 1: 2020 Emerging Venture Capital Models Benchmark, visualize the Venture Capital Industry performance against On-Demand Venture Capital Model and its Impact on Startup (Faster Access to Funding), Investors (Lower cost and risks with higher return) and corporate (large global startups pool access with faster go to market and lower acquisition cost).

Figure 2: 2020 Corporate Innovation Models Benchmark, visualize the Industry performance against On-Demand Innovation Model and its Impact on Innovation Commercialization (Root Cause and Capability Gaps that contribute to new product commercialization failures).

Disclaimer: ecosystem include own and peer network accounts, portfolio include startup with equity interest, investments, revenues and exit deals are not publicly announced and remain undisclosed unless stated otherwise by respective startup and corporate customers. Portfolio data posted on third party aggregators including CrunchBase and Pitchbook is inaccurate and not factual. Services requiring broker dealer and other investments licensing are handled by external partners who meet and exceed all regulatory requirement. Third party logo listed above, are for demonstration purpose to showcase example of industry peers, for the sole intention to help reader understand the complex visual graph, and not intended to portray or compare any organization in any shape or form. Logo are licensed under the GFDL.

Source: OneTraction

0 Comments

Latest on Michimich.com

- Tru by Hilton Columbia South Opens to Guests

- Christy Sports donates $56K in new gear to SOS Outreach to help kids hit the slopes

- "BigPirate" Sets Sail: A New Narrative-Driven Social Casino Adventure

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026

- Women's Everyday Safety Is Changing - The Blue Luna Shows How

- Microgaming Unveils Red Papaya: A New Studio Delivering Cutting-Edge, Feature-Rich Slots

- Japanese Martial Arts Association Explains the Practice of Meditation

- A&D PLM Action Group Validates Digital Twin-Digital Thread Investment Value in Benchmark Report

- Discover Strength and Roots in Libaax with Cedric Muhikira

- 5-Star Duncan Injury Group Expands Personal Injury Representation to Arizona

- The End of "Influencer" Gambling: Bonusetu Analyzes Finland's Strict New Casino Marketing Laws

- AI-Driven Cybersecurity Leader Gains Industry Recognition, Secures $6M Institutional Investment, Builds Momentum Toward $16M Annual Run-Rate Revenue

- TRIO Heating, Air & Plumbing Now Ranks #1 in San Jose

- Milwaukee Job Corps Center Hosts Alumni Day, Calls Alumni to Action on Open Enrollment Campaign

- Golden Paper Identifies Global Growth in Packaging Papers and Upgrades Its High-End Production Capacity

- Detroit-Born Puzzle Game Launches Nationwide XIXMAS Challenge With Gaming PC Giveaway

- Champagne, Caviar Bumps & Pole Performances — Welcome the New Year Early with HandPicked Social Club

- A New Soul Album: Heart Of Kwanzaa, 7-Day Celebration

- Allegiant Management Group Named 2025 Market Leader in Orlando by PropertyManagement.com

- NAFMNP Awarded USDA Cooperative Agreement to Continue MarketLink Program Under FFAB